📈

Metrics you need to know!

50+ Metrics founders need to have an understanding

Metrics you need to know that are typically tracked by most SaaS founders, product, marketing and sales teams.

🖥

SEO + PPC Cost

Typical investment and expected return in SEP and PPC ads

Things to consider for SEO:

- Avg. Cost per Click

- PPC Budget

- Expected Traffic on the Website

- Conversion Ratio (%)

- No. of Conversions

- Avg value of Product

- Total Sales

Things to consider for PPC:

- No. of Keywords ranking on the first page

- Estimate the average monthly search volume of a keyword

- Total Estimated Traffic

- Conversion Ratio (%)

- No. of Conversions

- Avg value of Product

- Total Sales

💲

SEO + PPC ROI

ROI on SEO and PPC. SEO has some additional benefits in the long run.

The key question would be "How much revenue is generated from PPC/SEO?"

🎢

Growth Cost

MoM / QoQ / YoY

Growth is an important metric to measure the growth and profitability of your business. Businesses measure growth in multiple ways: monthly, yearly and quarterly.

📊

ROAS - Return on ad spend

Return on ad spend (ROAS) is a metric used to measure the total revenue generated per advertising dollar spent. It is calculated by dividing the campaign revenue by the campaign cost.

👨🏻💻

CAC - Customer Acquisition Cost

Customer acquisition cost (CAC) enables companies to determine how much money they spend on attracting new customers, taking into account marketing, sales and other costs. For SaaS companies, it is important to make sure that the cost of acquiring customers does not exceed the amount of money generated by them. The following formula can be used to calculate exactly how much money a company spends on customer acquisition:

By measuring the amount of money spent on attracting customers, companies can then formulate the most cost-effective acquisition strategy.

💸

LTV - Customer Lifetime Value

Lifetime Value (LTV) is the cumulative gross profit contribution, net of CAC, of the average customer in a cohort.

LTV is determined by taking CAC, Dollar Retention, and Gross Margin into account to evaluate overall company health. If NRR is greater than 100%, LTV can increase indefinitely. However, if customers churn, LTV will flatten out and stop increasing.

Healthy cohorts cross the $0 LTV line before month 12, and LTV grows to at least 3x the original CAC over time.

🕵🏻♂️

Time to pay back CAC

It is the time of how many months it takes for a customer to generate enough gross profit to pay back their CAC.

Lower margin products with high CAC do poorly on payback.

🤥

CAC : LTV Ratio

The act of comparing your customer acquisition cost and customer lifetime value as a ratio.

🏗

Marketing % of CAC

The Marketing % of Customer Acquisition Cost is the marketing portion of your total CAC, calculated as a percentage of the overall CAC.

🤝

Marketing Originated Customers %

The Marketing Originated Customer % is a ratio that shows what new business is driven by marketing, by determining which portion of your total customer acquisitions directly originated from marketing efforts.

🙋♂️

Marketing Influenced Customers %

The Marketing Influenced Customer % takes into account all of the new customers that marketing interacted with while they were leads, anytime during the sales process.

📧

Email Marketing ROI

Total ROI from the email marketing campaign.

🎙

MQLs - Marketing Qualified Leads

Marketing qualified leads, or MQLs are leads who have expressed an interest through marketing channels or campaigns. That could be a download of an eBook or signup to your newsletter. These are great ways to track how your marketing efforts are helping to drive leads.

🍱

PQLs - Product Qualified Leads

Product-qualified leads (PQLs) are the new MQLs for some SaaS businesses. Remember when we mentioned signups? PQLs are signups that can be differentiated like this.

Signup is just signup. A PQL is signup followed by a series of engagements from that user. The difference is the intent to continue to use a product. As such, definitions for PQLs will vary from business to business.

📈

MRR - Monthly Recurring Revenue

MRR is the widely used metric to understand how much revenue customers are generating over the course of a month. In the SaaS realm, this amount of projected new revenue can come from either new sales or existing business expansions.

🚀

ARR - Annual Recurring Revenue

ARR reveals how much revenue a company generates over the course of a year. Both ARR and MRR offer organizations insight into the financial well-being of their business and its collective progress.

🙏🏻

ARR - Annual Run Rate

Annual run rate (ARR) is your monthly recurring revenue (MRR) annualized. It’s a prediction of how much revenue your company will generate annually based on your current MRR. This metric is predominantly used in companies with MRR and no ARR (Annual Recurring Revenue)

ARR assumes that nothing else will change in your business over the year (no new customers, no churn, or expansion revenue).

😇

CMRR - Committed MRR

Committed Monthly Recurring Revenue (CMRR) is a prediction metric that combines recognized monthly recurring revenue (MRR) with new sign-ups, churn, and downgrades/upgrades.

🧐

Contraction MRR

Contraction MRR is MRR lost from existing customers. The lost revenue could come from customers downgrading their plan, reducing the number of users on their plan, missing their payment or anything else that decreases the amount of money an existing customer pays you monthly.

There’s one thing you have to keep in mind though. Contraction MRR does not include customers who’ve cancelled. It should only include revenue lost from customers who are still active.

😎

Expansion MRR

Expansion MRR is additional MRR that comes from existing customers. It could be from users who’ve upgraded their account, purchased an add-on product, added additional users to their account or anything else that increases the amount of money they pay you each month.

In some cases, you can build opportunities for the expansion of MRR directly into your business model. For instance, if you sell a B2B SaaS product aimed at teams, you can charge per seat. As your customer’s team grows, they’ll add additional users to their account, which creates expansion MRR for you.

🤠

SaaS Quick Ratio

The Quick Ratio of a SaaS company is the measurement of its growth efficiency.

How reliable can a company grow revenue given its current churn rate?

💰

ROI - Return on Investment

Return on investment (ROI) is the value you need to understand how your work is impacting your bottom line. For marketing in particular, if you’re not securing a high return on your investment, then you need to assess your output.

🤕

Net Negative Churn

Simply, net negative churn is when current customers are spending so much additional money (services, upgrades, and add-ons) that your churn is offset by it.

😺

Total Cost of Service

Total costs incurred to build and operate your product.

For an average cost of service, sum up these expenses on an annual basis and divide by customer count to derive ACS.

🫡

Customer Concentration

Is your growth being driven by only a few big contracts or many small ones? In easy terms is it just concentrated from one source? It is a potential red flag if too much revenue is concentrated within a few large accounts or contracts. If fewer customers make up the majority of revenue, that’s there is a significant risk to the business that needs to be vetted.

On the other hand, if the largest customer is less than 10% of revenue, that indicates low customer concentration.

😳

ACV - Average Contract Value

ACV is a metric that shows the average yearly value of a customer’s subscription.

ACV helps companies figure out their strategy for sales and marketing. Calculate your company’s ACV by dividing the value of the contract by the total years of the contract.

🤯

Net Revenue Retention

Net Revenue Retention (NRR) or Dollar Retention measures how much of your revenue is generated by a cohort of customers each period relative to its original size.

NRR takes expansion revenue into account and can be greater than 100% if expansion exceeds churned and contracted revenue. The best SaaS companies have 120%+ NRR each year. NRR of less than 100% per year is evidence of a Leaky Bucket and is problematic.

😬

Magic Number

Magic Number is the Net New ARR for a period divided by its sales and marketing expenses from the prior period. Ideally, the ratio should be greater than one.

🦾

Gross Margin

Gross Margin reflects a company’s margin after subtracting the cost of goods sold (COGS) from revenue.

For SaaS companies, COGS typically consist of subscription costs on a monthly or annual basis to keep the product operating. There can be good reasons for lower gross margins early in a company’s lifecycle, but in the long term, SaaS companies should have a Gross Margin of over 60%.

low Gross Margins can be evidence of a classic automation problem where the company is putting their human force to work rather than automating existing workflows.

👌

Net Margin

Net Profit Margin or net margin is the percentage of net income generated from a company's revenue. Net income is often called the bottom line for a company or the net profit.

🔥

Burn Multiple

Burn Multiple is a company’s Net Burn divided by its Net New ARR in a given period (typically annually or quarterly).

It is a number of how much the startup is burning in order to generate each incremental dollar of ARR. The higher the Burn Multiple, the more the startup is burning to achieve each unit of growth. The lower the Burn Multiple, the more efficient the growth is.

For fast-growing SaaS companies, a Burn Multiple of less than one is amazing, but anything less than two is still quite good. If a startup has a high Burn Multiple but low CAC, that could indicate that sales and marketing costs have been miscategorized.

🤪

Hype Rate

The hype rate is used to measure capital efficiency, which equals Capital Raised (or Burned) divided by ARR. But we prefer Burn Multiple because it focuses on recent performance.

🔗

Active Users

Daily / Weekly / Monthly

The number of users who open and engage with your app/software on a daily, weekly and monthly basis.

🤬

Churn Rate

SaaS companies rely heavily on subscription services and the revenue it brings.

Customer churn is a primary concern. Customer churn refers to the measurement of customers or accounts that drop a business’ services within a given period of time. By determining the churn rate, SaaS companies can gain a deep understanding of how and when customers interact with their products, which enables them to form better retention strategies.

Once a customer leaves a company’s services, the race to attract and retain a new one begins. It is critical for scaling companies to determine customer churn rate, as it provides deeper insight into the overall health of the business.

😃

DAU / WAU

The ratio of daily active users to weekly active users.

A good metric for most SaaS startups is 60% DAU/WAU during non-holiday weekdays, meaning that the typical weekly user visits the site 3 out of 5 weekdays.

🤣

DAU / MAU

The ratio of daily active users to monthly active users.

A good metric for most SaaS startups is 40% DAU/MAU during non-holiday weekdays, meaning that the typical monthly user visits the site at least two weekdays per week or 8 times per month.

🤙

NPS - Net Promotor Score

The Net Promoter Score (NPS) enables companies to assess the loyalty of their customer base.

NPS allows companies to quickly determine how their customers feel about their products. Companies often measure NPS through the use of simple survey questions, which usually address consumers’ willingness to reuse a product or recommend it to someone else.

For young SaaS businesses, this metric is especially useful, as it allows organizations to make any needed adjustments to their product or services early on so they can keep growing their customer base.

🫶

ARPA - Average Revenue Per Account

Or ARPU - Average Revenue Per User in most cases

The average revenue per user (ARPU) is the average amount of revenue you earn from each of your active customers monthly.

🙌

Activation Rate

Activation rates, sometimes also known as sign-up to paid conversion rates, are the percentage of your customers that go from newly acquired to performing an activity that signals they are using your software.

Calculate the activation rate by dividing the number of users who complete an activity by the number of new users who signed up.

👣

Customer Attrition Rate

Attrition Rate also known as customer turnover is the rate at which you lose customers over time. This metric differs from the churn rate in that it doesn’t account for the net total including new users. It focuses only on customers lost.

This measure is vital to track monthly or annually to spot an uptick in customer dissatisfaction. Calculate your customer attrition rate by dividing the number of customers leaving by your total number of customers in the period.

💂

Net Retention Rate

NRR is a churn metric. It measures the percentage of recurring revenue from existing customers.

NRR looks at a company’s success in SaaS renewal metrics, such as extending contracts and earning additional revenue from its customer base.

In coms cases, it is also synonymously used with Net Revenue Retention

👵

Lead Velocity Rate

Lead velocity rate is the percentage increase of qualified leads over months.

Calculate LVR by subtracting the qualified leads for the last month from the qualified leads for the current month, and dividing the difference by the leads for the previous month.

🕵🏻♂️

Average Selling Price

ASP is the average price a product sells for across all customers. ASP is important because it shows investors what clients are willing to pay for your software.

Calculate ASP by dividing your software revenue by the number of customers.

😱

Conversion Rate

Conversion rate is the most common KPI used by many marketers to understand how much traffic is converting into leads, or sales.

You should be calculating conversion rates through these conversions; - Form submissions - Making a purchase - Call tracking - Lead Magnet downloads - Newsletter signup + many other conversion types.

😻

Behaviour Flow

Behaviour flow is essentially understanding "end-to-end" where users land on your site, to than the other pages or destinations they visit.

👀

Trial Period to Conversion Rate

The number of users who pay at the end of their trial period typically after 7/14/30 days of trailing your product.

Things to consider;

- How effective are your total efforts within product and customer service to turn trial users into paying users?

- How effective is your onboarding process for new/trial users?

- What can you do within the product to encourage activation?

👍

Traffic by Source + Medium

Understanding where your users come from and where they land on your website is crucial. Knowing where they come from helps make better decisions around strategy + investment into channels that acquire more potential users/customers.

👏

Website Traffic

Understanding and reporting on unique + repeat visitors are important to making better decisions on growth. However, it's important to not grow an unhealthy obsession with these metrics. Choose whether monthly, weekly or daily metric matters to you.

A metric that does matter that coincides with daily, weekly + monthly windows is repeated visitors/rate of returning visitors. Overlap this with other key factors such as landing page destination + source/medium, and you can learn valuable information for optimisation.

👫

Cohort Analysis

Cohort Analysis helps you analyse how users interact and engage with your product. There are two main types of cohort analysis; - Acquisition cohorts (website/when they signed up_ - Behavioural cohorts (how they use your product) Your cohort analysis measurements can include; - How often do users engage within their first 14 days? - How often do they come back? - When do they churn? - Which features retain users or are frequently used by users? + others.

🧑🦯

Existing Customer Revenue Growth Rate

Working out ways to achieve more revenue from your existing customers through upsells or other methods helps increase the LTV of your customer base without the need for acquisition costs.

💼

Email Open Rate

Email open rate is the most important metric when it comes to email marketing (along with the clickthrough rate) and indicates the number of users who opened your email, compared to the total number of people you sent it to.

🏋️

Click Through Rate

Clickthrough rate (CTR), it’s the ratio of users who click on a specific link to the number of total users who view an email campaign.

⚡️

Deferred Revenue

Deferred revenue is money received in advance for products or services that are going to be performed in the future.

🔥

Revenue Growth Rate

MoM / QoQ / YoY

Revenue Growth Rate measures the month-over-month percentage increase in revenue. It’s one of the most common and important startup KPIs. The Revenue Growth Rate provides a solid indicator of how quickly your startup is growing.

🤗

Gross Profit

Total revenue - Cost of goods sold (COGS)

🫣

Net Profit

Net Profit is surplus cash (money made) after all expenses have been paid

📢

Virality

The virality / Viral coefficient is the number of new users or customers the average customer generates. This can be through a formal business referrals program or simply through sharing and inviting others customers to use your product - but the key is that these users also convert to paying customers or users.

🫣

Platform Risk

Simply it is the dependence on one source of traffic or customers.

Also getting too tied up with the current algorithm for existing marketing channels.

Key Metrics to be included in your company dashboard

To make key informed decisions on your business moving forward. Your investors would love this too!

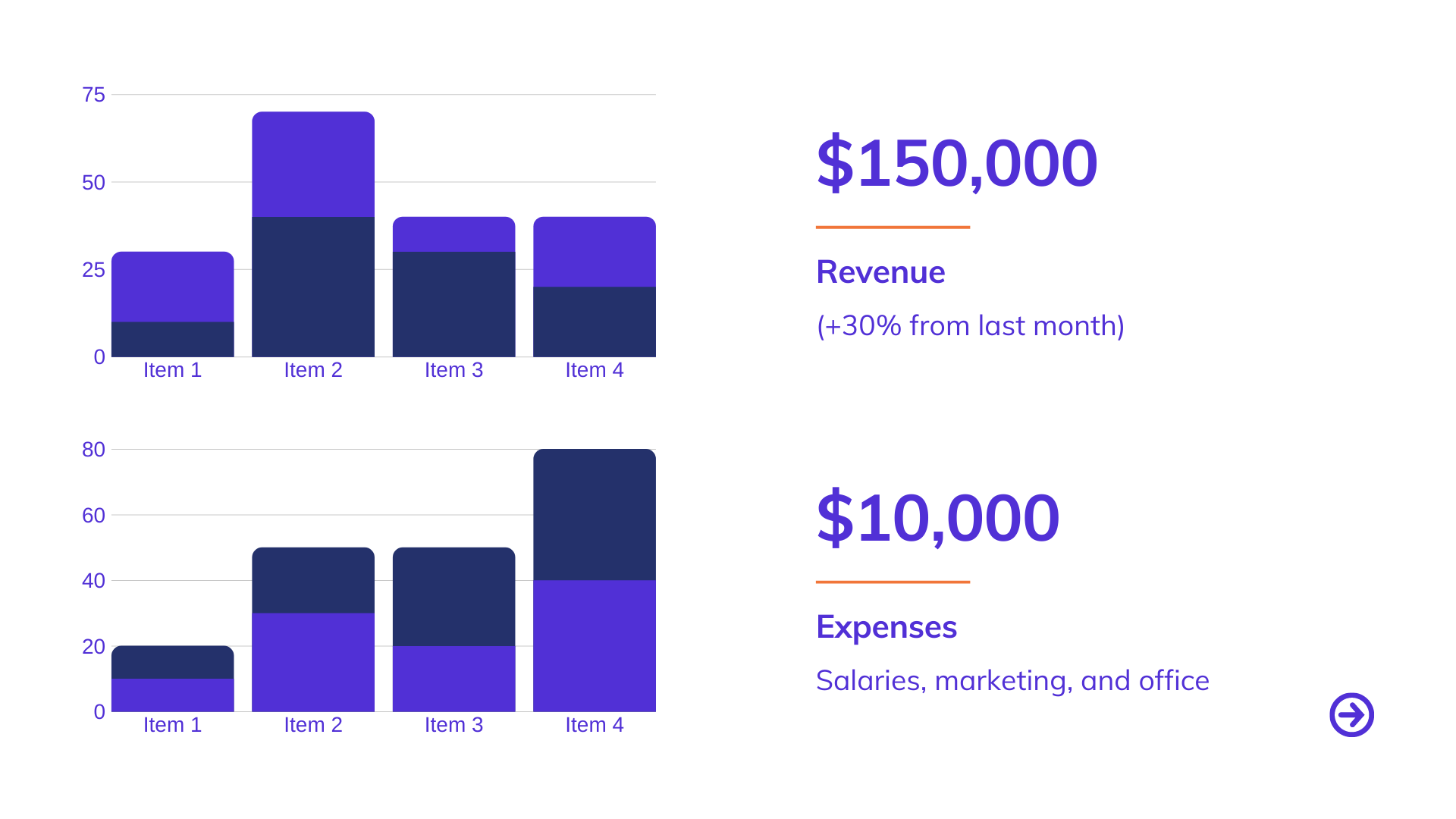

📈 Revenue Metrics

- How much revenue did you earn this month? Last month? The month before?

- Which acquisition channels drove revenue?

- What is the cost of your product (or subscription)?

- How much of your revenue is attributed to the product vs. your consulting services?

- Excluding marketing, what are your margins?

📊 Customer Acquisition Metrics

- What is your cost per acquisition?

- What is your website conversion rate?

- How many daily active users do you have? How many monthly?

- What is your retention rate?

- What is your monthly/yearly churn?

💸 Fundraising Metrics

- How much have you raised to date?

- How much are you raising now?

- What were the terms in your last round?

- What are the terms in this round?

📌 Milestone Metrics

- What milestones do you expect to hit with this raise?

- What metrics do you care about when measuring the health of your business? Why?

🕵🏻♂️ Slicing and Dicing

- How have your conversion rates changed over time? Have they increased, decreased, or stayed the same?

- How have different customer acquisition channels performed? For example, what is the difference in conversion rate between Facebook ads versus LinkedIn ads?

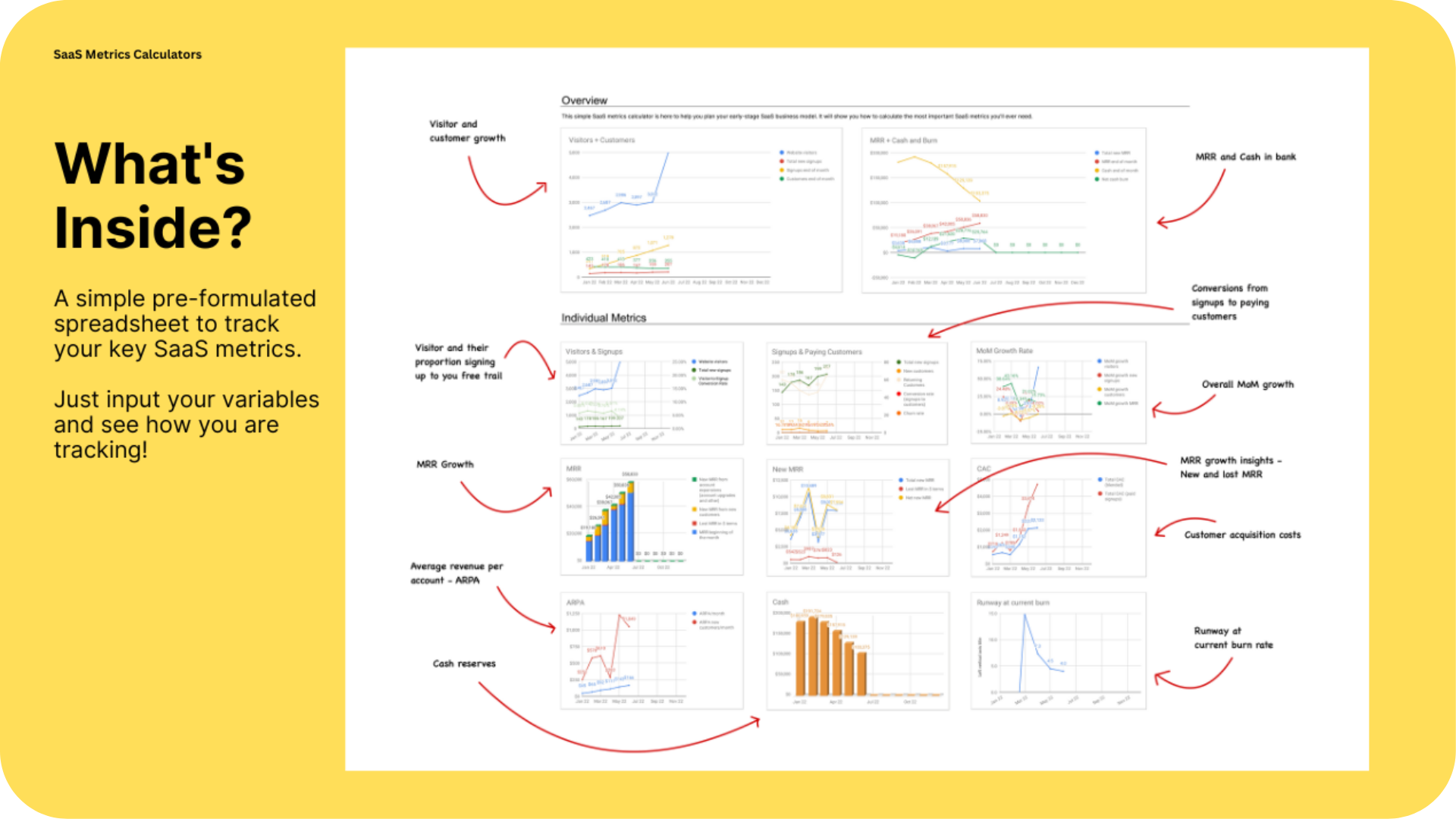

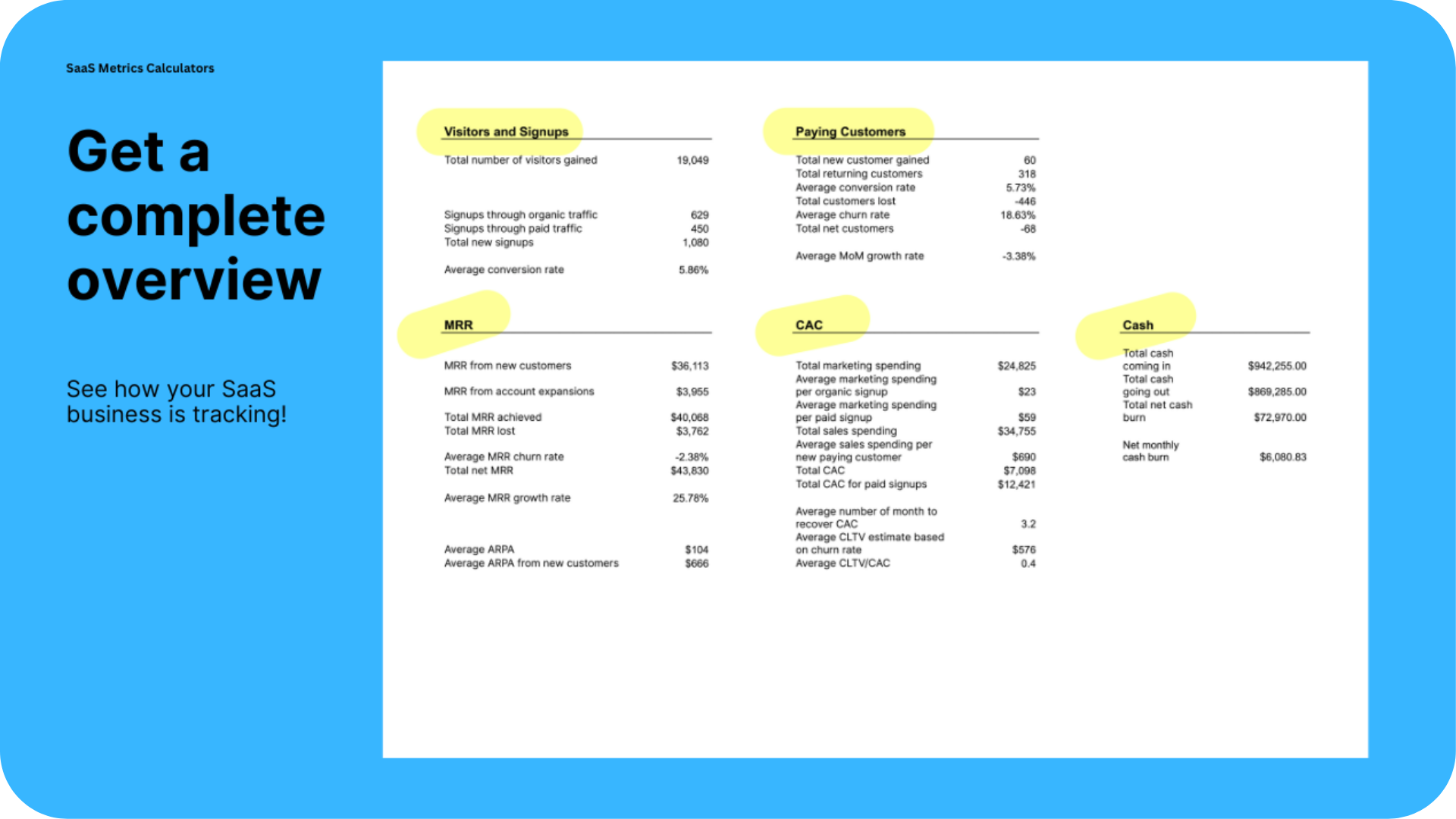

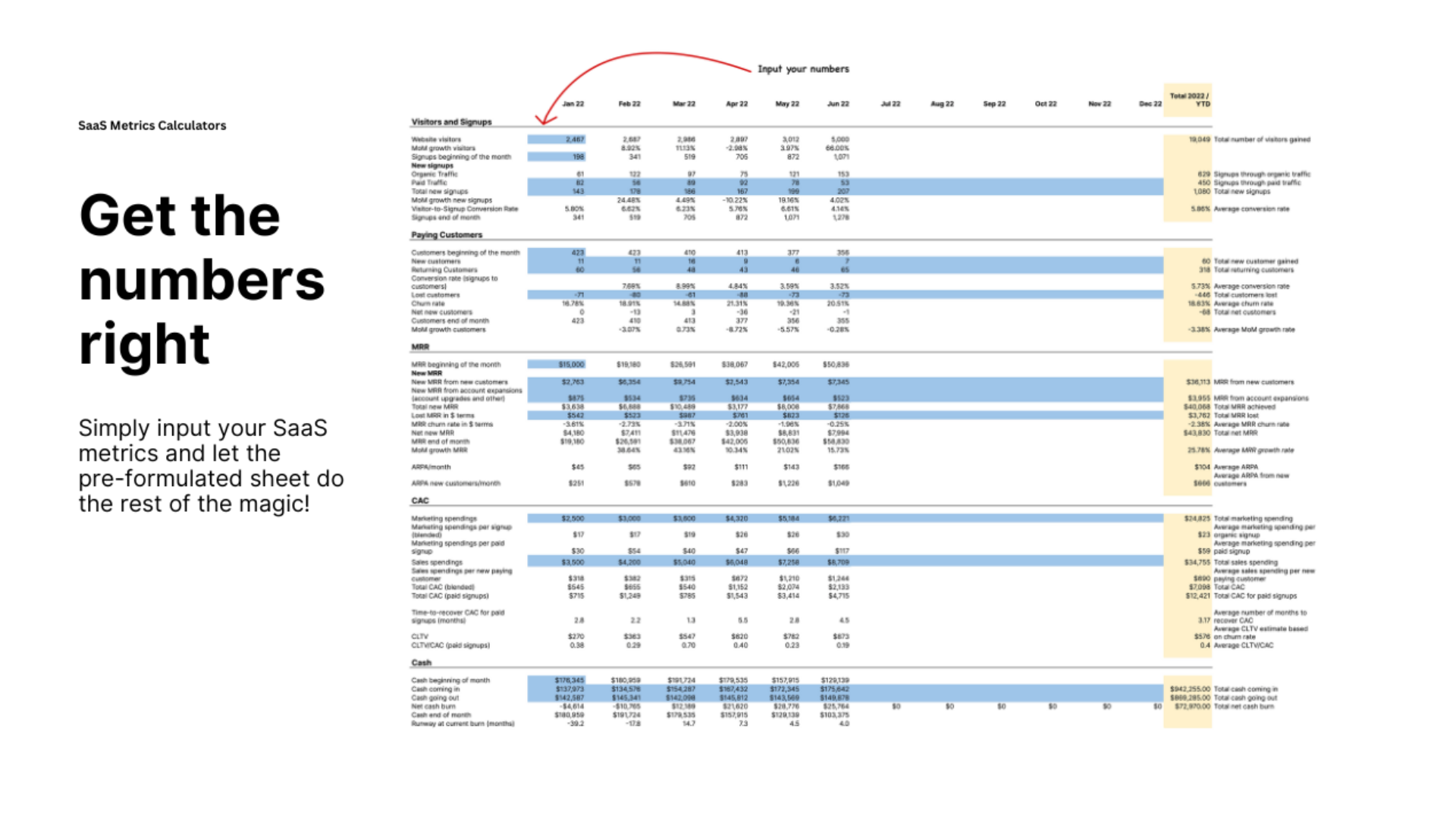

SaaS Metrics Calculator

Calculate all your SaaS growth metrics in a simple dashboard 📊

Acknowledgement

Startup and SaaS metrics are inspired by their original sources below.

- https://sacks.substack.com/p/the-saas-metrics-that-matter

- https://builtin.com/saas-metrics

- https://baremetrics.com/academy/saas-metrics

- https://www.netsuite.com/portal/resource/articles/erp/saas-metrics.shtml

- https://www.ruleranalytics.com/blog/insight/tracking-saas-metrics/

- https://www.dansiepen.io/saas-marketing-metrics-kpis-for-startups

- https://viral-loops.com/product-launch/metrics?

- https://www.hustlefund.vc/know-your-metrics

Founders' Book

#1 Platform for first-time founders and early-stage startups

Copyright © 2023 Founders' Book. All rights reserved.

Product